You reach retirement phase when it is the time of life when you no longer have to work to live comfortably, Having saved enough you are able to rely on savings or passive forms of income. This is generally achieved through the best retirement plan in Singapore, which means preparing for a steady stream of money into your bank account after ceasing to work on a monthly basis. It entails setting aside some funds or money while you invest specifically with that goal in mind. Your retirement strategy highly depends on your final goal, income, and your age.

As a rule of thumb, retirement planning advisors have recommended saving at least 15% of your gross annual earnings. For a positive retirement, savings would begin in your 20s the sooner you start to work and last throughout your working years.

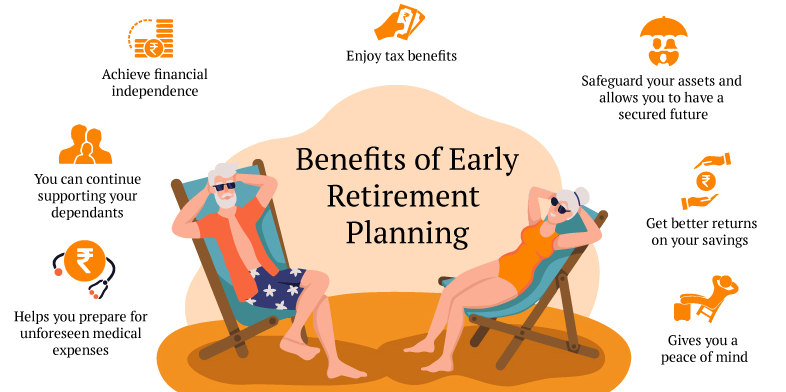

Why Plan For Retirement?

You retire from years of working on an employment basis, but not for a lifetime. As older people, life changes and no longer requires you to be a part of the corporate rat race. You might want to get on a new set of dreams for your post-retirement life. At the same time, you will want to maintain your day-to-day lifestyle without worrying about expenses that keeps coming!

To maintain the standard of living

If you want to continue living the life you’re currently living after retirement, then, it becomes absolutely essential to start on a retirement plan so that you can cover your expenses with this monthly income as a regular income.

To be emergency ready

As time passes, we get older and many older citizens do not want to be financially independent of others especially their growing children. A retirement plan would be a great way to save up for costly medical expenses. With the right plan you can certainly build up an emergency fund and be prepared for any unexpected events.

To be prepared for a longer life

If you live in a country where the standard of living is higher, then it is necessary to save a lot more for your post-retirement phase. This way you will not run out of money.

To overcome inflation

Some countries in Asia have families earning below the poverty line while prices of consumer goods have soared. Plus, the COVID pandemic has drastically brought down the economy which has left many countries to count on losses more than gains. Since this disruption has negatively affected the global economic growth in 2020 beyond anything you will see inflation take over. This can affect your standard of living too. What you buy today for $50 would become $100 tomorrow. Therefore by planning for retirement, you can invest your money to grow and beat down inflation when it happens.

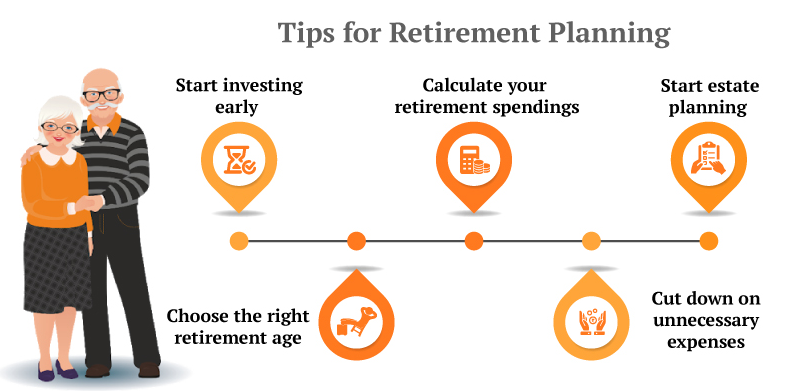

How to plan your retirement?

When you plan your retirement, one of the first steps to take is to envision and manifest it to happen. Consider thinking about how you would want to spend your final days and then move on to evaluating the money you would need to endure and sustain. That said, keep in mind about inflation as this can take a great hit and affect your savings badly.

Soul Wealthy to start your best retirement plan In Singapore

As one of the leading providers of independent financial advice and planning in Singapore, Soul Wealthy puts its clients first to offer expert advice to help them come up with the best retirement plan in Singapore possible.

Hi, I am Adam Smith, Admin Of TechSketcher, Creative blogger and Digital Marketer.